For time stamps, the CEO’s report is at 6:15 to 18:11 and the Q&A is at 23:34.

I wish all REITs would be as communicative as RCR and upload the annual meeting on their website. I find it reassuring for small individual investors and it actually shows that management cares about us.

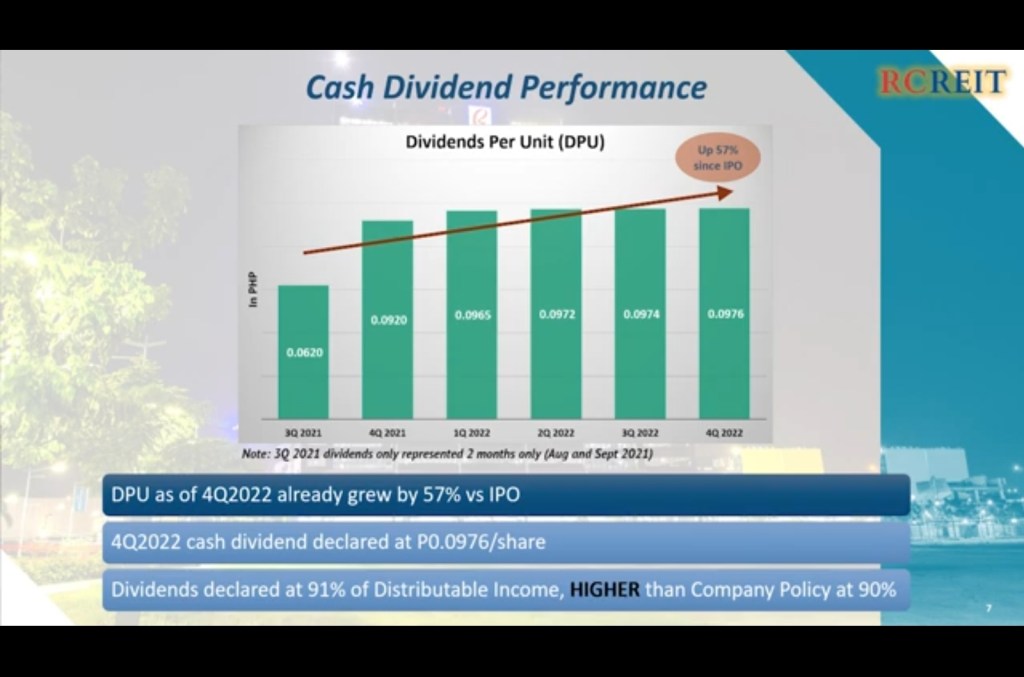

A key takeaway was RCR’s ability to increase their quarterly dividend per share:

Don’t be too impressed with the 57% increase though since the initial dividend only represented 2 months. Its really more of a 6-7% increase over 5 quarters – still very respectable given the impact of flexible work on office rental properties. The fact that RCR maintained an occupancy rate of 98% is a testament to the quality if their assets, tenants and managenent.

Another piece of information from this presentation was that RCR had no debts. This is neither a good or bad thing but it does give them the option to borrow for future acquisitions.

What I found lacking was the nonmention of their growth plans. Does Robinsons Land have any intention of infusing its malls, hotels and warehouses into RCR? What is their yearly growth target in terms of gross leasable area? I guess we’ll have to wait and see.